.jpg)

As is clear from the definition, the value of equipment or machinery after its useful life is termed the salvage value. Simply put, when we deduct the depreciation of the machinery from its original cost, we get the salvage value. Suppose a company spent $1 million purchasing machinery and tools, which are expected to be useful for five years and then be sold for $200k.

Units of Production

It represents the amount that the asset is expected to be worth when it is no longer useful or productive to the business. This value is determined by various factors such as the condition of the asset, market demand, and technological advancements. The salvage value is important for accounting purposes as it allows for the calculation of depreciation expense. It represents the amount that a company could sell the asset for after it has been fully depreciated. On the other hand, book value is the value of an asset as it appears on a company’s balance sheet.

How Salvage Value Is Used in Depreciation Calculations

If the company estimates that the entire fleet would be worthless at the end of its useful life, the salvage value would be $0, and the company would depreciate the full $250,000. There may be a little nuisance as scrap value may assume the good is not being sold but instead being converted to a raw material. For example, a company may decide it wants to just scrap a company fleet vehicle for $1,000. This $1,000 may also be considered the salvage value, though scrap value is slightly more descriptive of how the company may dispose of the asset. Following formulas are used in net present value calculation when there are tax implications.

IRS Asset Depreciation Guidelines

- It refers to the estimated value that an asset will have at the end of its useful life.

- The four depreciation methods available are straight-line, units of production, declining balance, and sum-of-the-years’ digits.

- It is the value a company expects in return for selling or sharing the asset at the end of its life.

- The percentage of cost method multiplies the original cost by the salvage value percentage.

- Companies can also use comparable data with existing assets they owned, especially if these assets are normally used during the course of business.

We can see this example to calculate salvage value and record depreciation in accounts. Moving on, let’s look through the details of how the salvage value can be used in depreciation calculations. The salvage or the residual value is the book value of an asset after all the depreciation has been fully expired.

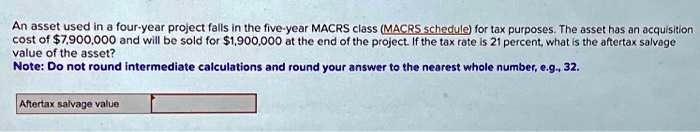

How to Calculate After Tax Salvage Value

If the asset is sold for less than its book value then the difference in cost will be recorded as the loss of the tax values. It’s the amount a company thinks it will get for something when it’s time to say goodbye to it. Companies use this value to figure out how much to subtract from the original cost of the thing when calculating its wear and tear. It’s also handy for guessing how much money they might make when they get rid of it. Salvage value helps to figure out how much your old stuff is worth when it’s done being useful. It’s the estimated value of something, like a machine or a vehicle, when it’s all worn out and ready to be sold.

Straight-Line Method

This differs from book value, which is the value written on a company’s papers, considering how much it’s been used up. This method estimates depreciation based on the number of units an asset produces. The straight-line depreciation method is one of the simplest ways to calculate how much an asset’s value decreases over time. It spreads the decrease evenly over the asset’s useful life until it reaches its salvage value. The balance sheet shows the net book value of an asset, which is the original cost minus accumulated depreciation, helping stakeholders understand the asset’s current worth.

It assists organizations in making sound financial decisions, managing depreciation, and optimizing resource allocation. To calculate the annual depreciation expense, the depreciable cost (i.e. the asset’s purchase price minus the residual value assumption) is divided by the useful life assumption. Salvage value plays cares act 401k withdrawal rules a crucial role in determining the worth of an asset at the end of its useful life. It represents the estimated value of an asset when it is no longer useful or productive to a company. Understanding salvage value is significant as it influences various financial decisions regarding asset management and depreciation.

On the other hand, salvage value is an appraised estimate used to factor how much depreciation to calculate. This method requires an estimate for the total units an asset will produce over its useful life. Depreciation expense is then calculated per year based on the number of units produced. This method also calculates depreciation expenses based on the depreciable amount. Have your business accountant or bookkeeper select a depreciation method that makes the most sense for your allowable yearly deductions and most accurate salvage values. If you earn capital gains on the disposal of an asset, you’ll typically be required to pay tax on that amount.

Last modified: November 11, 2024