Blogs

Credit Suisse sustained an exodus away from client fund you to definitely delivered it for the verge away from failure and you can triggered the first ever before merger out of a couple of global systemically crucial banking institutions. Subscribers just who deposit their cash at the Borrowing from the bank Suisse, now a great device of UBS, secure as much as 1.8percent to the fifty,one hundred thousand Swiss francs (54,000) or maybe more kept for three weeks, based on among the someone, who requested to stay anonymous while the matter is actually private. While the Given hikes interest levels, analysts has adjusted the traditional off 1 trillion away from February, when places had been estimated to go up by 3percent in the 2022. The brand new twenty-four companies that had been the fresh KBW Nasdaq Bank List and home 60percent of the country’s bank dumps try projected to see deposits decline 6percent inside the 2022, according to the Wall Path Log. For those burdened having mastercard expenses, devising an organized month-to-month cost package is extremely important so you can gradually get rid of the newest a great numbers.

After Fidelity ‘Glitch,’ Angry Users Face Constraints to your Deposits | deposit 5 get 20 fs

Depositors from the Cayman Isles’ part of Silicone polymer Area Lender discovered that from hard means when its places had been caught because of the FDIC the 2009 season following bank unsuccessful within the March. Places inside the domestic lender offices from the U.S. you to surpass 250,one hundred thousand per depositor/per lender are perhaps not covered by FDIC. According to its regulatory filings, since December 29, 2022, JPMorgan Pursue Bank N.A good.

MicroStrategy’s 5.4B Purchase Last week Adds to Their Bitcoin Hoard; Stock Stumbles

- Alternatively, Pulley are an alternative enemy gaining business and you will and make their earliest physical appearance to the checklist.

- The business said they got funded the newest latest bitcoin requests out of the sales out of convertible ties and you can the brand new inventory previously few days.

- Inside the an uncommon flow, moreover it fined a few Citi managers, former CFO Gary Crittenden and you can trader-relationships chief Arthur Tildesley Jr.

- Individual credit investments are money or other personal debt investment to customers that are undertaking businesses, committing to a home, otherwise you desire investment to expand team operations.

- Looking into 2025, if your Given provides cost in which he or she is or lowers them far more, Video game costs you are going to stand flat otherwise refuse slightly.

This means that the fresh mega banks would be the franchisor and they’ve managed to move on their fake financial assessments and you can faux fret testing to help you the fresh Provided, for styles benefit. Of your 20 chairmen which preceded me personally at the FDIC, nine confronted most the fresh panel participants from the opposite team, and Mr. Gruenberg since the chairman less than President Trump up to I changed your since the president inside the 2018. No time before has a majority of the brand new panel made an effort to prevent the newest chairman to follow her plan. And you can my personal door is often open to the individuals happy to take part such that befits the newest venerated institution our company is privileged to help you serve.

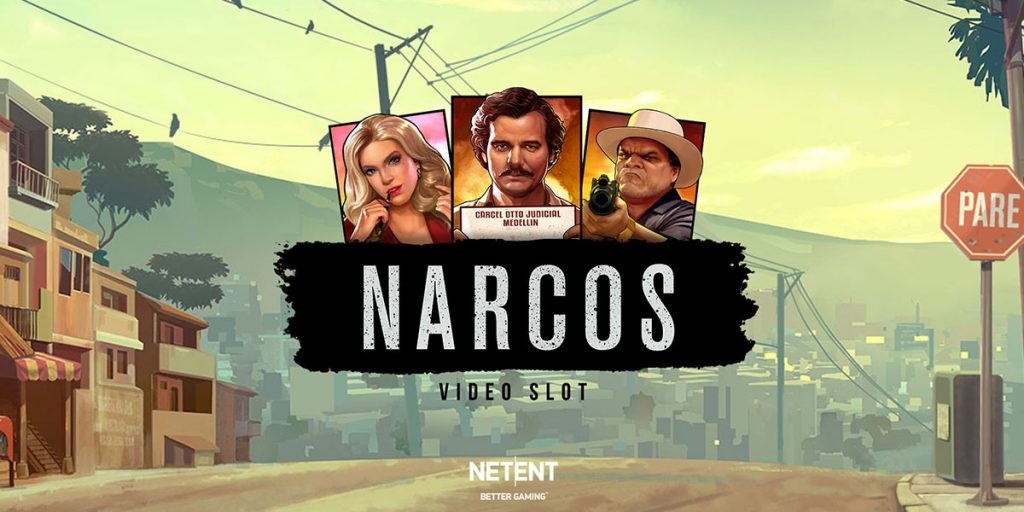

Total, WSM casino certainly ranking among the best Bitcoin and you can crypto gambling enterprises on the market on the market deposit 5 get 20 fs . The big options decided by the prominence, analysis and you can regularity from queries. This is the account the new crossword hint Financial put (poker legend Ungar) looked inside Wall surface Highway Log puzzle to the December 19, 2024. One of them, one services shines having a good percent suits which includes an amount of 6 letters. Dennis Shirshikov, head out of progress during the Awning, underscores the importance of optimizing which disaster fund.

The financial institution should also make an effort to retain clients that would have had fund in banking institutions that will now consider bequeath its chance. If the proposal endures while the structured, that’s likely to indicate an incredibly high economic strike in order to JPMorgan Chase or any other super financial institutions that have considerable amounts from uninsured deposits. There will be something more better about this uncharacteristic spurt away from kindness of JPMorgan Chase. From the soliciting at least 5 million inside the the brand new external currency to obtain the 6 percent Cd, the lending company seems as effectively obtaining to grow their already brow-raising amount of uninsured deposits.

That it article provides historical comparisons to aid clarify how these points may have enhanced the seriousness of current operates prior to most other severe operates you to definitely took place in 1984 and you can 2008—the most significant works within the U.S. history because the Higher Anxiety and you can until recently. Inside a statement, First Republic inventor Jim Herbert and you may Chief executive officer Mike Roffler told you the new “collective support improves the liquidity status (…) and that is a ballot of rely on to possess Very first Republic plus the entire You banking system.” The new disperse scratches a dramatic effort by the loan providers to strengthen the system and you may simplicity issues from local bank downfalls. The new president, on the concur of one’s Senate, and designates one of many designated professionals because the chairman of your own panel, so you can suffice a four-year label and one of the appointed participants because the vice chairman of your panel. The two ex officio participants will be the Comptroller of your own Currency and also the movie director of the User Economic Security Bureau (CFPB). When a bank will get undercapitalized, the fresh institution’s number one regulator things a warning on the lender.

After St. Denis completed a conference phone call to your professional, Cassano suddenly burst to your place and you can first started screaming in the him to own talking-to the newest York work environment. Then launched you to definitely St. Denis had been “on purpose excluded” of any valuations of the most extremely dangerous areas of the brand new types collection — thus preventing the accountant from performing their jobs. Exactly what St. Denis portrayed try openness — and the final thing Cassano expected is actually transparency. Regarding Lehman Brothers, the newest SEC got a chance six months until the crash to flow against Cock Fuld, a guy has just named the new poor Ceo of them all by the Collection magazine. A decade before the crash, a good Lehman lawyer titled Oliver Budde is actually going through the financial’s proxy statements and pointed out that it had been using an excellent loophole of Limited Stock Systems to hide 10s of huge amount of money from Fuld’s compensation. Budde informed his employers one Lehman’s entry to RSUs try dicey at best, but they blew your from.

Federally chartered thrifts are in reality regulated by the Workplace of the Comptroller of your Currency (OCC), and you can county-chartered thrifts from the FDIC. Silicone Valley Bank and you may Trademark Bank portrayed the next and you will third biggest financial problems, correspondingly, in the You.S. background. (The most significant is Washington Common, and this failed inside 2008 economic crisis.) In regards to how big is its places, we have been speaking of minnows compared to the deposit coverage during the the new whale financial institutions for the Wall Street. Because the huge amounts of bucks inside home-based uninsured places was on the line from the each other hit a brick wall banking companies, government bodies provided an excellent “unique exposure analysis” you to definitely acceptance the newest FDIC to fund the uninsured residential dumps. You to definitely action led to vast amounts of dollars in the extra losings to help you the fresh FDIC’s Deposit Insurance Fund (DIF).

That could be a big lose regarding the 2023 mediocre of twenty-six, nevertheless the rules nevertheless face judge and you may potential governmental pressures. Delight sustain with our company while we target which and fix their individualized directories. A prospective Trump administration’s pro-organization position, reducing controls and a good interest rate background. Today, production is actually impressive for short and you can long-label Dvds — our favourite urban centers discover her or him is actually CIT Financial.

Berkshire might have been unloading bank offers, and that JPMorgan Chase and you may Wells Fargo, because the around the start of 2020 pandemic. He stays ready, along with his company’s solid bucks heap, to act once more should your situation need it, Buffett said during the his annual shareholders’ appointment. This blog also offers remarks, research and you may research from your economists and benefits. Opinions shown are not necessarily the ones from the brand new St. Louis Given or Federal Set-aside Program. “The new incentives out of highest expert creditors to run on the a too big to falter standard bank.” Record away from Financial Balances, 2019.

Currency industry money enlarge from the over 286bn amid put flight

Now, he inserted 5 billion to your Goldman Sachs in the 2008 and one 5 billion inside Financial away from The united states last year, permitting stabilize all of the individuals businesses. The brand new Banking Work out of 1935 produced the newest FDIC a long-term department of the bodies and given permanent deposit insurance policies handled during the 5,100000 top. All number you to definitely a particular depositor features inside the membership in every kind of possession class at the a particular bank are additional along with her and you can are covered to 250,100000. Fruit is probably the most significant enigma on the AI landscaping among the top tech businesses. The business could have been slow in order to diving on the AI arena, and it is too soon to tell if the their strategy around Apple Cleverness (the newest sale nickname to own Apple’s AI equipment) pays away from. Nevertheless the genuine fireworks came whenever Khuzami, the new SEC’s manager away from enforcement, discussed a new “cooperation initiative” the newest department got has just uncovered, in which managers are now being given incentives to report con they have witnessed or the time.

Hence, it compensation will get feeling how, where as well as in just what buy things are available within list categories, except where blocked legally for the financial, family collateral or other family lending options. Other variables, for example our very own proprietary website legislation and you can if or not something is offered in your area or at your notice-chosen credit rating diversity, also can feeling how and in which points appear on your website. Even as we strive to give an array of also provides, Bankrate does not include information regarding all the economic or credit equipment or service.

The largest departure away from historic reviews is the fact depositors from the banking companies you to knowledgeable operates recently have been strangely linked to otherwise similar to each other. At the Silicone Area Financial, depositors had been connected thanks to well-known investment capital backers and you can coordinated the withdrawals as a result of mobile interaction and you will social networking. During the Trademark Financial and Silvergate Bank, large servings from depositors had been crypto-asset businesses that used the a couple of banking institutions the real deal-go out repayments with each other, company habits centered on swinging currency instantaneously. These crypto-advantage community depositors may also have already been including sensitive to counterparty risk given the volatility inside crypto-investment areas over the prior season. This will not the very first time you to definitely Citigroup’s Citibank provides put a tool to your taxpayers’ direct to your irresponsible method it will team.

Last modified: December 30, 2024